Foreign direct investment reviews 2024: Netherlands

The Netherlands, complementing its existing sector-specific regulations, has introduced a general investment screening mechanism to enhance the protection of its national security across a broader range of sectors.

On June 1, 2023, the Act on Security Screening of Investments, Mergers, and Acquisitions (Wet veiligheidstoets investeringen, fusies en overnames, or Vifo Act) came into force, broadening the scope of the Netherlands’ existing sector-specific investment screening policies. This act, which applies to both Dutch and non-Dutch investors, introduces a mandatory and suspensory national security regime. It retroactively applies to all qualifying investments made after September 8, 2020, integrating with and extending the reach of the prior sector-specific regulations.

Summary of major changes in 2023

The Vifo Act entered into force on June 1, 2023

- Two governmental decrees and a ministerial regulation based on the Vifo Act also came into force on June 1, 2023. This concerns:

- The Sensitive Technology Decree (Besluit toepassingsbereik sensitieve technologie)

- The Security Screening of Investments, Mergers and Acquisitions Decree (Besluit veiligheidstoets investeringen, fusies en overnames)

- The Ministerial Regulation on Security Screening of Investments, Mergers and Acquisitions (Regeling veiligheidstoets investeringen, fusies en overnames)

- The Investment Screening Agency (Bureau Toetsing Investeringen (BTI)) published three guidance documents elaborating on certain criteria of the Vifo Act based on its case experience. These guidance documents elaborate on the criteria of “internal restructuring,” “assets” and “being active on”

- In January 2023, the minister announced that the acquisition of chip manufacturer Nowi by Nexperia would be reviewed retrospectively under the Vifo Act. On October 24, 2023, the minister announced that the retroactive effect does not apply in this case, because Nowi’s products do not qualify as dual-use products or military goods. As a result, the acquisition is now final

- A legislative proposal for the defense industry is under preparation. This proposal introduces a new sector-specific investment review mechanism for the defense sector and was put up for consultation on 1 July 2024. Internet consultation on the Act will last until 1 September 2024.

In 2023, the minister introduced a bill to amend the Energy Act. On 4 June 2024, the House of Representatives passed this bill with the effect that a notification requirement is now included regarding changes in control in specific product installations.

Who files?

Under the Vifo Act, either the acquirer or the target should make the notification. If the target is bound by a non-disclosure agreement, the target will be the appropriate party to handle the notification.

Types of deals reviewed

The Vifo Act applies to target undertakings that are active in the field of sensitive technology, vital providers and operators of high-tech campuses.

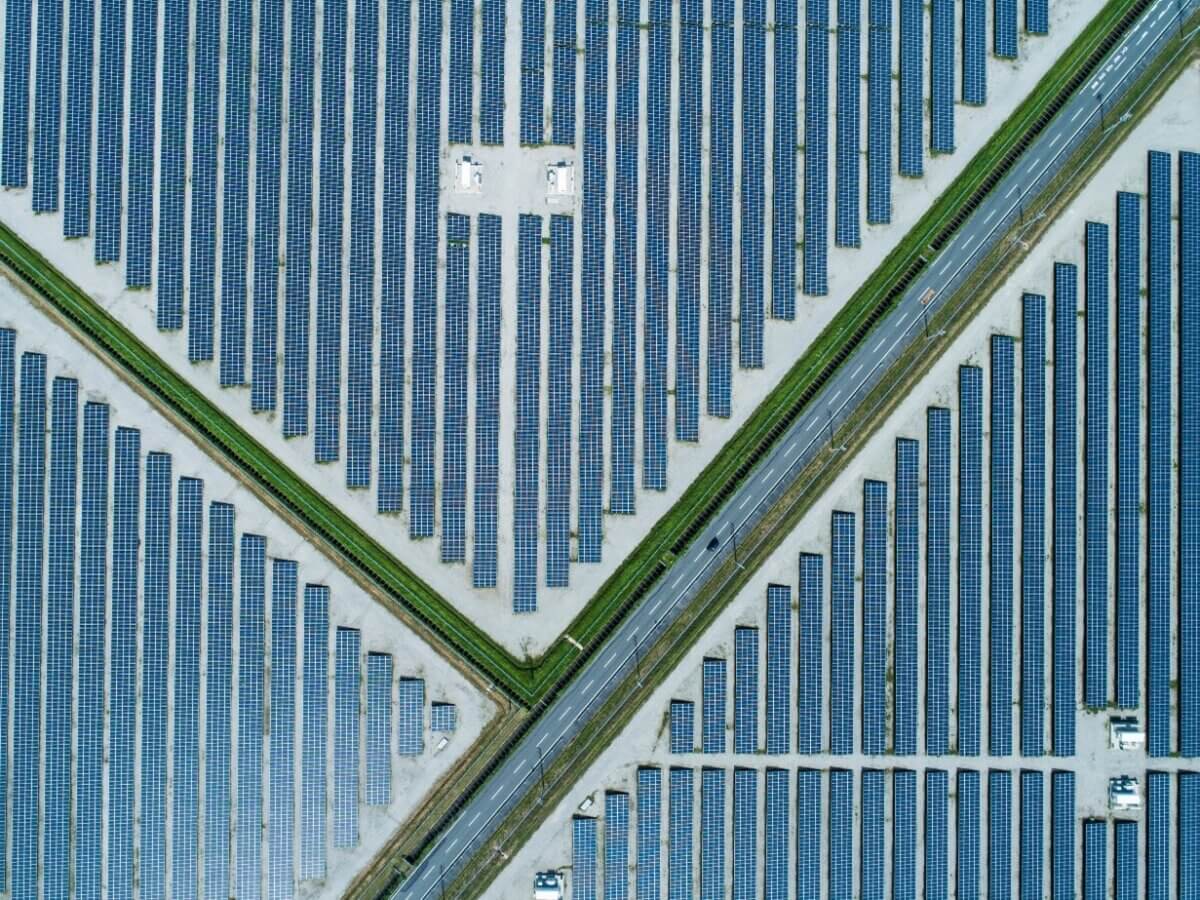

Vital providers, for example, include Schiphol Airport and the Port of Rotterdam, but also operators of heating networks, nuclear or renewable energy providers and certain providers in the field of banking.

Sensitive technologies include dual-use products and military goods that are subject to European export control. The Sensitive Technology Decree curtails and expands the scope of what constitutes (highly) sensitive technology. Highly sensitive technology includes a number of dual-use products and military goods, as well as semiconductor technology, quantum technology, photonic technology and high assurance products.

An acquisition leading to a change of control in such undertakings must be notified under the Vifo Act. The concept of “change of control” is assessed in the same way as under the EU Merger Regulation.

A lower threshold exists for undertakings active in the field of highly sensitive technology. Regarding such undertakings, the acquisition or increase of significant influence must be notified.

Significant influence exists if: a person can exercise at least 10, 20 or 25 percent of the voting rights in the shareholders’ meeting; or there are agreements between shareholders that amount to a shareholder acquiring or increasing significant influence as defined above; or the acquirer has the right to appoint or dismiss one or more of the target’s board members.

Acquiring or increasing significant influence must be notified if one of the thresholds of 10, 20 or 25 percent is exceeded as a result of the transaction. These thresholds relate to voting rights or the ability to appoint or dismiss directors.

The Vifo Act only applies if no sector-specific regulation is applicable.

Scope of the review

Following a notification under the Vifo Act, an assessment is made as to whether the investment, merger or acquisition poses a risk to national security. National security refers to security interests that are essential to the democratic legal order, security or other important interests of the Dutch state or social stability interests.

The Vifo Act explicitly notes the following interests: safeguarding the continuity of critical processes; maintaining the integrity and exclusivity of knowledge and information of critical or strategic importance to the Netherlands; and preventing unwanted strategic dependence of the Netherlands on other countries.

To assess the potential risk that an investment may pose to national security, particular attention is given to a number of factors.

These include: the transparency of the investor’s ownership structure and relationships; whether the investor is directly or indirectly subject to restrictive measures on the basis of national or international law, such as chapter 7 of the Charter of the United Nations; the security situation in the country or region of residence of the investor; the investor’s criminal record; the degree of cooperation of the investor in the review procedure; and the nature of any incorrectly submitted information and the motives behind it.

For acquisitions involving vital providers, the financial stability and track record of the acquirer are also included in the assessment. Acquisitions involving sensitive technologies involve an additional assessment of the acquirer’s track record and motives for the acquisition.

Review process timeline

The review procedure under the Vifo Act consists of two phases. The first phase starts with the notification. After notification, the minister has eight weeks to assess whether the investment could potentially cause a risk to national security. The first phase ends with a notification that no review decision is necessary or that further review is necessary. The failure of the minister to make a timely decision is deemed to be a decision that no further review is necessary.

If further review is deemed necessary by the minister, the second phase starts. The minister then has another eight weeks to take a decision. The second phase can be extended up to six months as well. However, if the first phase period has been extended, this time will be deducted from the second phase period.

A “stop the clock principle” applies during the review procedure, meaning that if the minister requests additional information, the decision period is suspended until the required information has been provided. The decision period can also be extended by an additional three months if the member state is required to share the notification with the European Commission and/or other member states in accordance with the EU FDI Regulation.

How investors can protect themselves

Investors should make timely notifications to the minister if required under the Vifo Act or sector-specific regulations.

Investors should also bear in mind that the Vifo Act contains a standstill obligation. Investors must therefore wait for the minister’s approval before proceeding to complete the transaction. Starting the implementation prematurely constitutes gun- jumping, which is subject to high fines. A failure to notify or providing wrongful or misleading information may also result in the imposition of a fine of up to €900,000 or 10 percent of worldwide turnover.

Although sector-specific regulations do not contain a standstill obligation, completing a transaction before approval entails risks. Indeed, if the minister prohibits the transaction or attaches conditions to the transaction, the investment may have to be partially or fully reversed.

Potential developments in 2024

Technological developments might lead to an expansion of the scope of the Vifo Act. For this reason, the Dutch legislator chose to include the scope of the concept of sensitive technology in secondary legislation , instead of in the Vifo Act itself. This allows for easier and faster adjustments of the scope of the Act.

Given the current geopolitical tensions, a strict interpretation of national security will not be out of the question.

Finally, in the last quarter of 2024 the results of the consultation concerning the new sector-specific regulations for defence are likely to be made known.